Commercial Real Estate Loan Analysis

Assessing credit risk in commercial real estate loans. As the industrys only independent one-stop commercial real estate services shop we offer an expanding fleet of services and solutions from sizing to securitization and beyond.

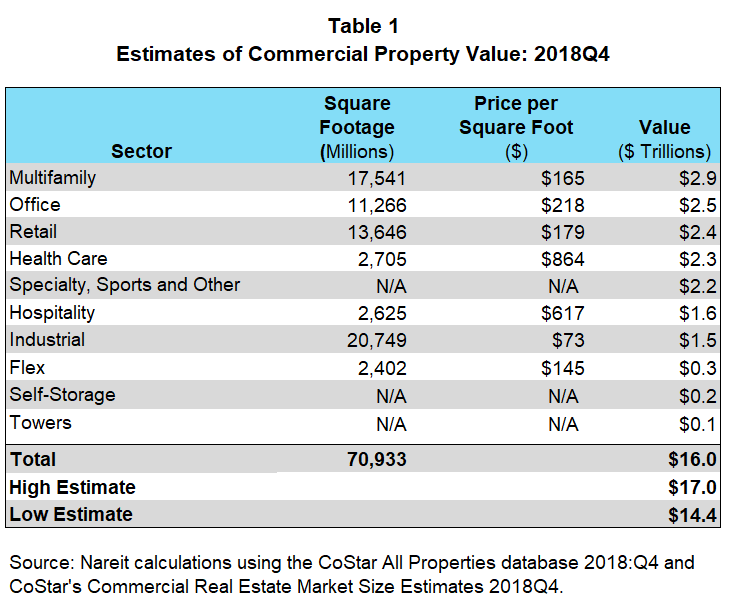

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Such an analysis would measure the depth and breadth of the portfolios vulnerability to changes in real estate.

Commercial real estate loan analysis. CRE loans are generally made to investors such as corporations or organizations that own and operate commercial real estate. Qualtik a start-up developing software that helps community banks and investment funds analyze their commercial real estate loans in real time has landed Keystone Banks as a new client and its president as a new advisor. 12 USC 1464c1B authorizes federal savings associations to invest in residential real estate loans including multifamily residential real estate loans without limit provided the volume and nature of the.

Just enter a price together with an email address to. Commercial real estate loans u sing Moodys CMM Stress Testing framework. This report describes how we derive credit loss estimates for the CRE loan portfolios held by CCAR firms.

1292021 A commercial real estate loan is a mortgage secured by a lien on a commercial rather than residential property commercial being defined as any income-producing real estate. Real Estate Fintech Firm Qualtik Lands New Client and Advisor. 1082019 Loan analysis gives the creditor a measure of safety on the loan by determining the probability that the borrower will pay back the loan principal Principal Payment A principal payment is a payment toward the original amount of a loan that is owed.

Using a clear practical framework and real-world applications this program supports career advancement for both junior lending officers and. Permissible real estate exposures for federal savings associations are described in 12 USC 1464 of the Home Owners Loan Act HOLA. Trepp offers a suite of solutions for commercial real estate practitioners who depend on comprehensive data analytics and insights to maintain their competitive advantage.

Typically Loan-To-Value Ratios for commercial real estate loans are capped at 75 or 80. Robust scenario analysisstress testing capabilities that support regulatory compliance. To make this model accessible to everyone it is offered on a Pay What Youre Able basis with no minimum enter 0 if youd like or maximum your support helps keep the content coming typical real estate Excel models sell for 100 300 per license.

In other words a principal payment is a payment made on a loan that reduces the remaining loan amount due rather than. The Commercial Loan Analyst position provides underwriting and financial analysis of multifamily and commercial real estate properties and markets and prepares financial documents supporting the analysisThe Commercial Loan Analyst will be a resourceful contributor to the team who can operate in a fast-paced environment take direction and multi-task under tight deadlines while. This certificate program provides the specialized credit risk assessment and lending decision skills to underwrite and structure commercial real estate CRE loans.

Commercial Real Estate Credit Analysis. Built on extensive proprietary dataset and calibrated to recent financial crisis. Create and edit financial models that allow for the valuation of commercial real estate assets and sizing of real estate loans.

Combines deep experience in all property types with extensive market knowledge and exposure to the capital markets. The first ratio commercial lenders look at is the Loan-To-Value Ratio. The LTV equals the amount of the commercial mortgage divided by the market value of the property as determined by a commercial appraisal.

Track issuer and industry trends as well as macroeconomic performance drivers which could impact underwriting of commercial property. This is our first study leveraging the loan -level commercial banks data collected via Moodys Analytics CRE Credit Research Database CRD. 492020 In one scenario created by Trepp which provides analysis of commercial real estate among other services the cumulative default rate across commercial mortgages overall will rise to 8 up significantly from the current 04 default rate.

Flexible framework that allows clients to customize the models. 922014 Loan to Value Ratio LTV The loan to value ratio is simply the ratio of the total loan amount borrowed in relation to the value of the property. 11252020 Download the Commercial Mortgage Loan Analysis Model.

9242019 A CRE loan is a mortgage secured by a lien on a commercial property. Tune in to the latest episode of The TreppWire Podcast exploring recent events in. While loan-level sensitivity analysis is a valuable tool for all banks originating CRE loans this type of analysis could be performed on a portfolio-wide basis.

The three ratios are. For example suppose the requested loan amount for a commercial real estate property was 1000000 and the the appraisal came in with a value of 1250000. 322021 Underwrite and perform credit analysis on loan collateral across all major property types.

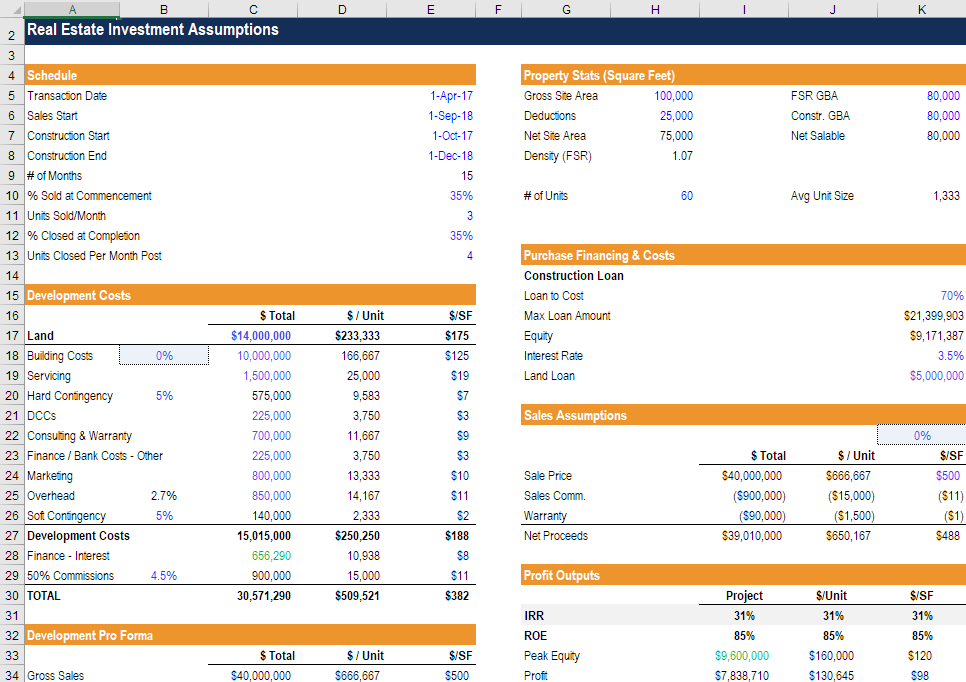

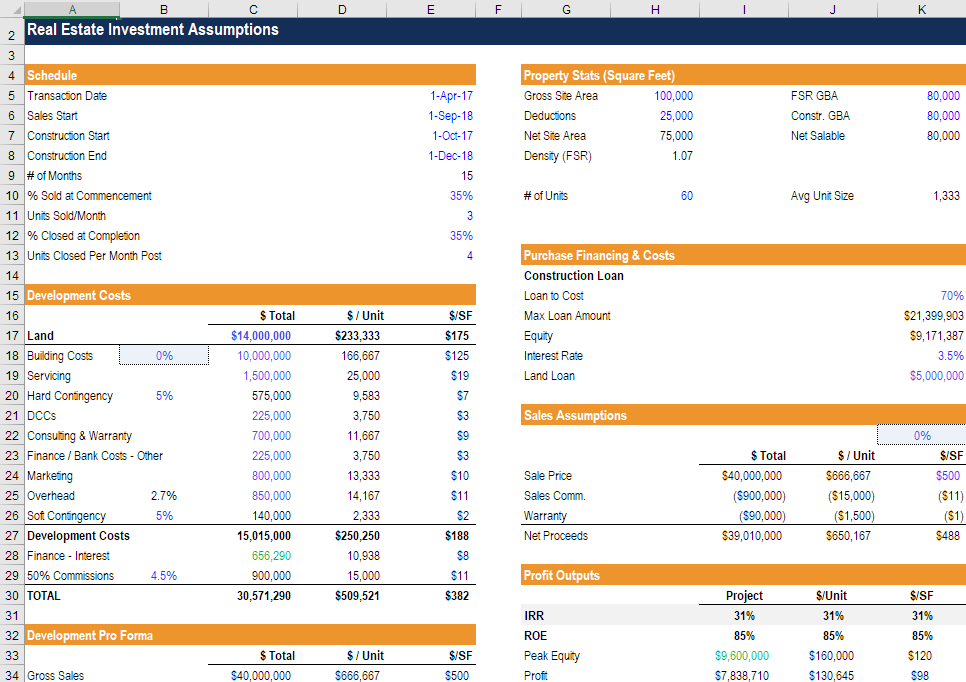

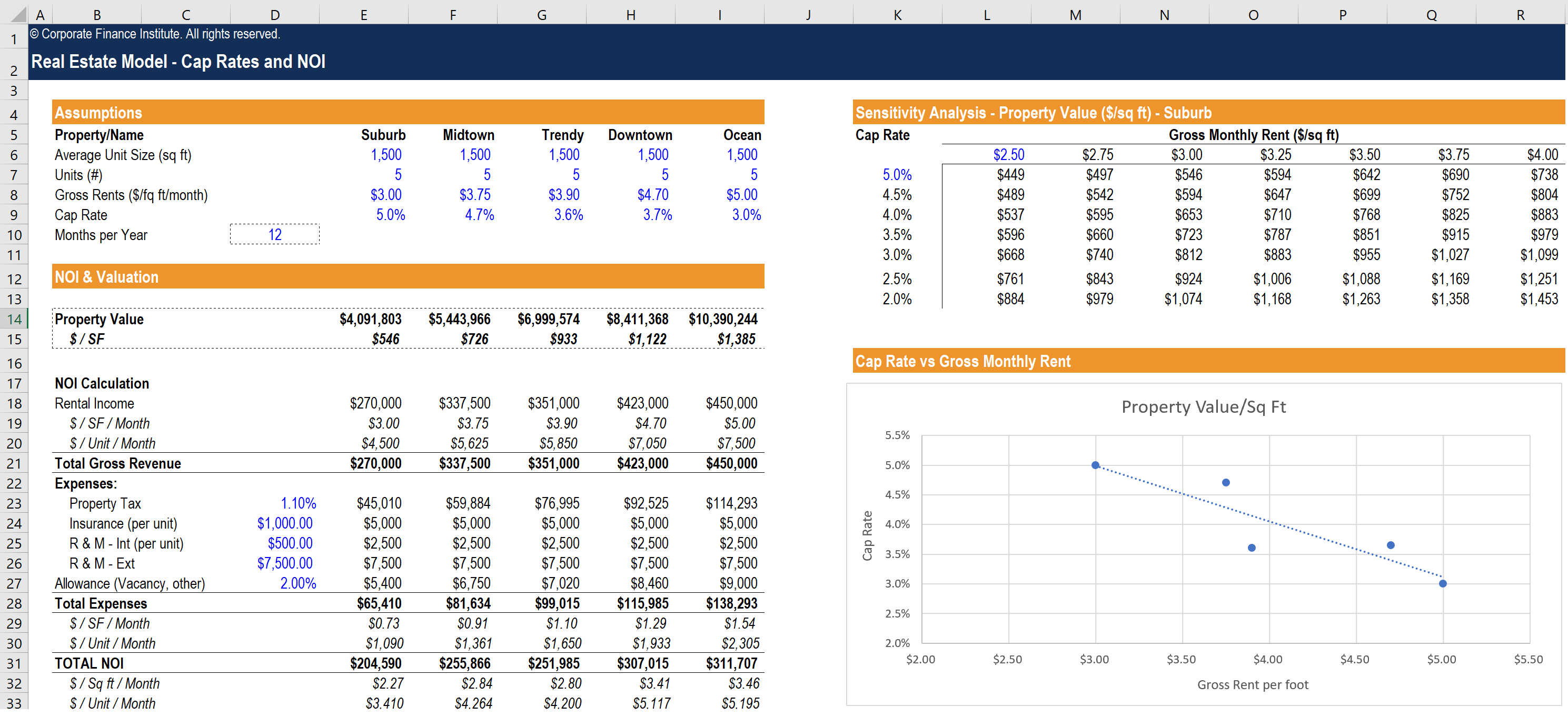

Foundations Of Real Estate Financial Modeling What You Need To Know

Foundations Of Real Estate Financial Modeling What You Need To Know

Understanding Commercial Real Estate Loan Covenants During The Pandemic Realogic

Understanding Commercial Real Estate Loan Covenants During The Pandemic Realogic

Commercial Real Estate Scorecard S P Global Market Intelligence

Commercial Real Estate Scorecard S P Global Market Intelligence

Foundations Of Real Estate Financial Modeling What You Need To Know

Foundations Of Real Estate Financial Modeling What You Need To Know